Services Offered by “Solutions Consulting” in Audit Processes

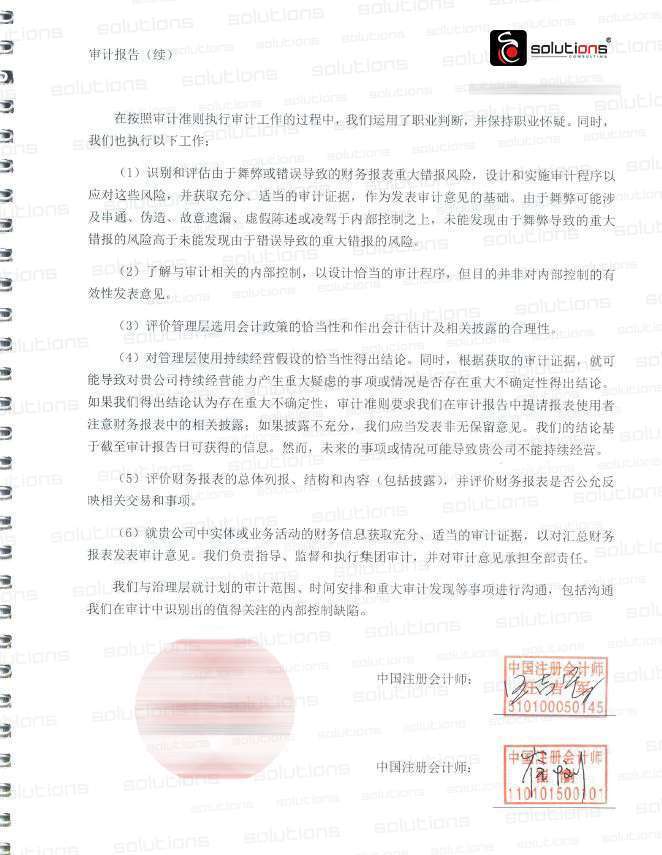

Audit is a process whereby practicing accountants review the authenticity, completeness, reasonableness, and legality of the vouchers and documents provided by a company within an accounting year, in accordance with accounting standards.

Audit Preparation: Preparing for audits by ensuring all financial records are accurate and up-to-date, helping to streamline the audit process.

Compliance and Standards Adherence: They can provide guidance to ensure the company’s financial practices adhere to relevant accounting standards and legal requirements.

Document Review and Verification: Assisting in reviewing the authenticity, completeness, reasonableness, and legality of financial documents to ensure they accurately reflect the company’s financial position.

Report Preparation: Helping in the preparation of audit reports based on original documents, providing a clear and accurate picture of the company’s financial status.

Stakeholder Communication: Interpreting and presenting the findings of the audit to shareholders and decision-makers, ensuring they understand the financial health of the company.

Risk Assessment and Management: Identifying potential risks or areas of concern in the financial processes and suggesting improvements to enhance compliance and accuracy.

Internal Controls Evaluation: Assessing the effectiveness of internal controls to prevent fraud and errors, ensuring the reliability of financial reporting.

Continuous Support and Improvement: Providing ongoing support and advice to improve financial processes and compliance, even after the audit is completed.

Clear Report: The accounting records are clear and correct, fully reflecting the actual situation of the company.

Qualified Audit Report: Some parts of the accounts are not clearly stated or only partially correct, reflecting only part of the company’s actual situation.

Disclaimer Report: The accounting records are completely unclear and incorrect, failing to reflect the actual situation of the company at all.

After the audit, clients can declare and pay taxes to the tax bureau based on the actual data from the audit report.

In China, both foreign-invested enterprises and domestically funded enterprises are not subject to mandatory annual audits due to the requirement of monthly tax filing. However, according to the “Company Law” and the “Foreign Investment Law,” companies must conduct regular audits to ensure compliance, enhance transparency, identify risks, and optimize internal controls. Through regular audits, companies can timely detect potential operational risks, such as financial risks, market risks, and operational risks. Moreover, deficiencies in internal controls identified during the audit process can prompt companies to improve their processes, thereby enhancing operational efficiency and financial management levels.

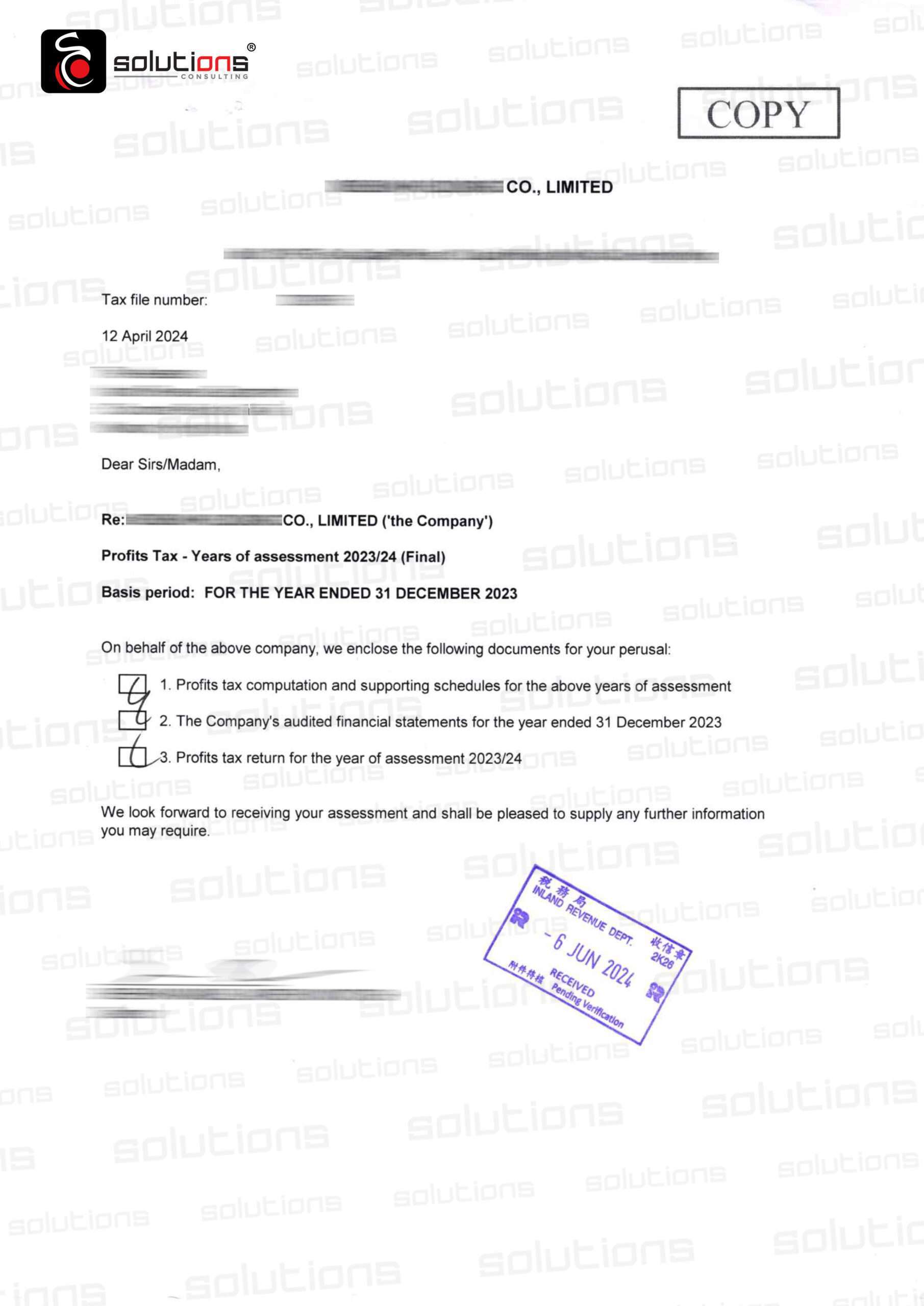

HK Companies will receive their first Profit Tax Return 18 months after establishment.

How to handle the tax return:

Applicable situations:

The company has no accounts (but necessary annual expenses such as company annual review fees, director’s salary must be listed in the tax return).

The company has accounts, but there’s only a small balance for bank deductions with no actual transactions.

Companies that have opened accounts and have regular transaction activities need to conduct an audit before reporting and paying taxes to the tax bureau.

What are the consequences of not handling the tax return promptly?

Note: In Hong Kong, companies must address the tax return upon receipt, choosing either zero declaration or conducting an audit and paying taxes accordingly. If ignored for a month without applying for an extension, penalties from the tax bureau will be imposed. Repeated warnings from the tax bureau could lead to serious consequences, including prosecution and imprisonment.

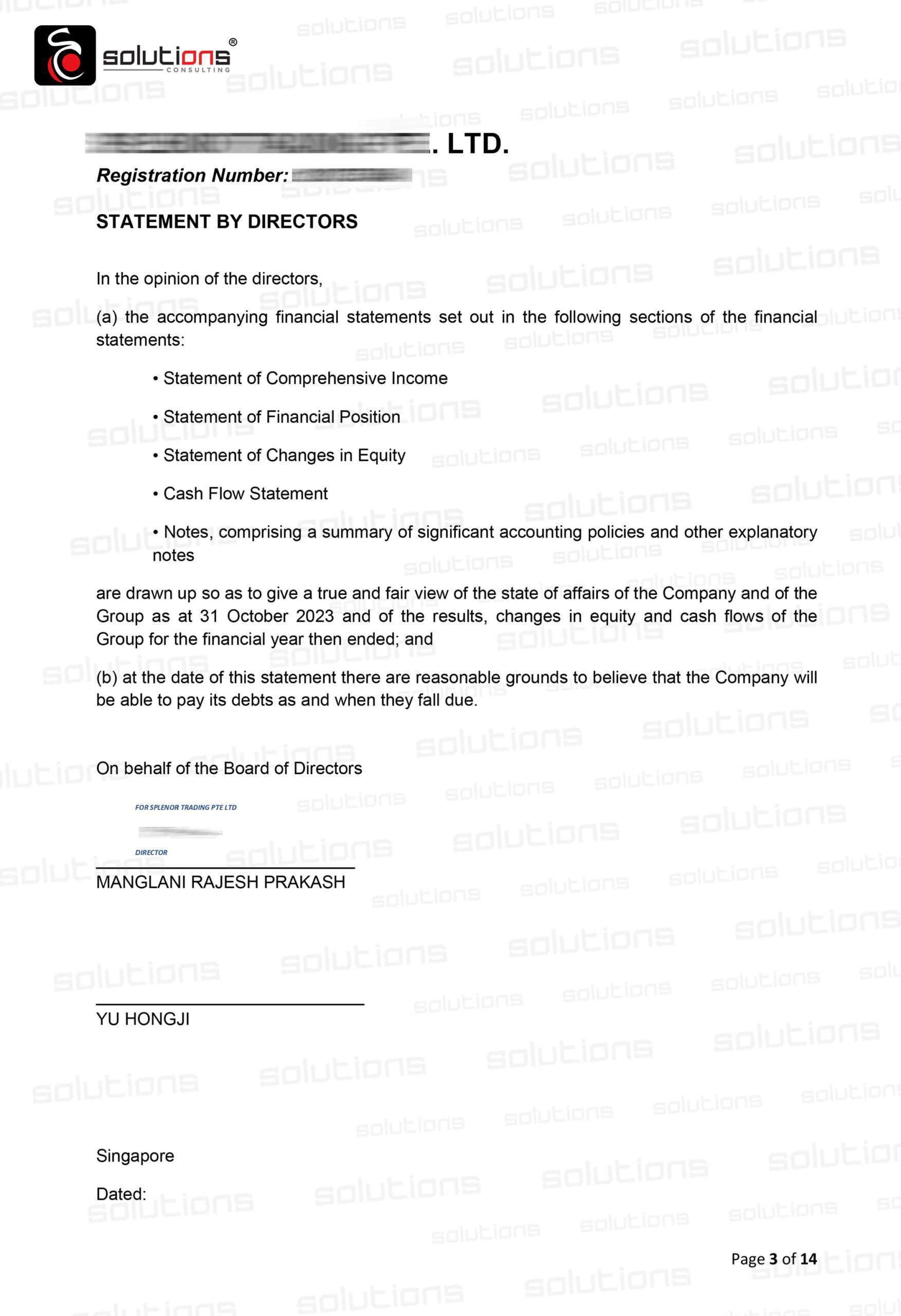

Within 18 months of registration, new companies must:

1.Hold an Annual General Meeting (AGM)

2.Submit the accounting annual return and financial statements

3.Declare taxes to the tax bureau

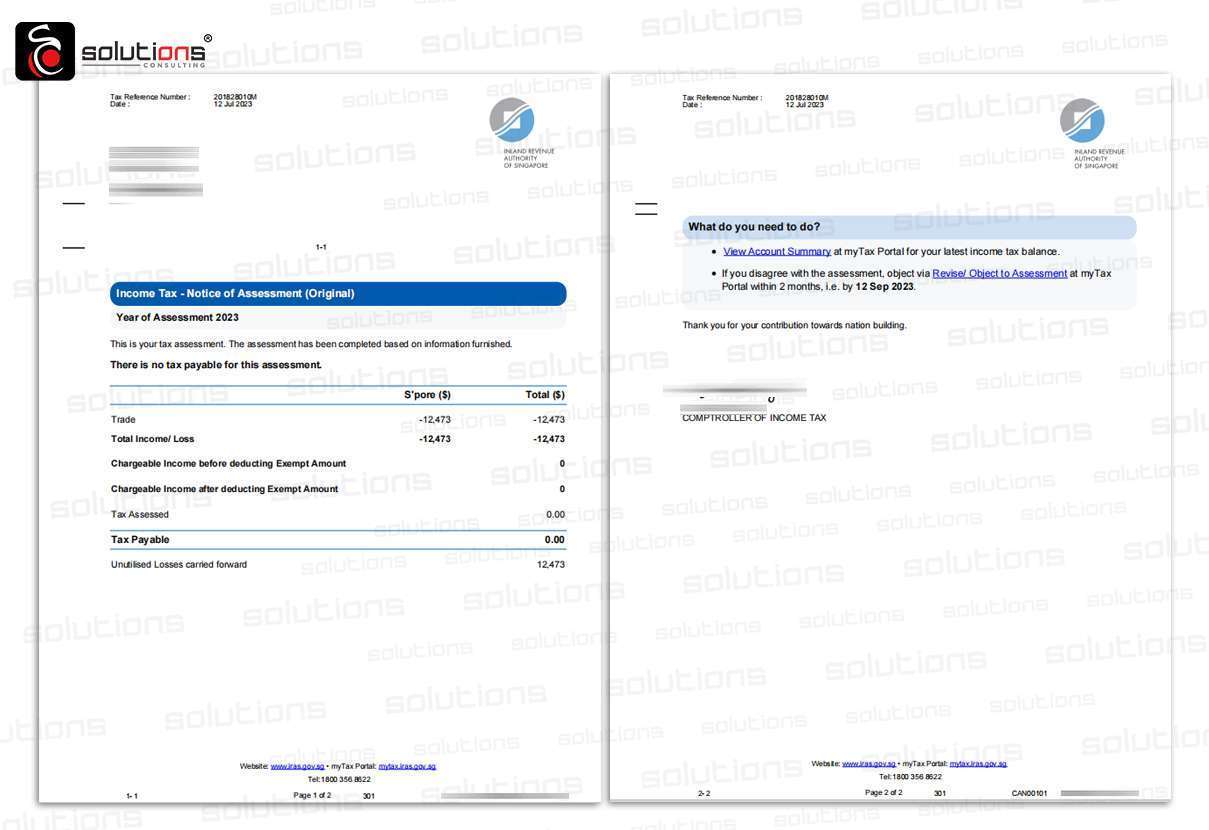

Notably, in Singapore, bookkeeping and auditing are separate processes, and an audit is required only if certain criteria are met.

Under new regulations, companies meeting the following conditions are defined as “small companies” and are directly exempt from audit:

1.Annual total turnover of less than SGD 10 million

2.Total assets of less than SGD 10 million

3.Fewer than 50 employees

If does not meet the exemption criteria, contact us for detailed consultation on auditing.

Our service included:

System Technical Setup& Basic Training

Bookkeeping:

Financial Statement Preparation:

Fixed Assets & Depreciation

Monthly/Yearly Closing Procedures

The accounting services provided official government are now in effect. For companies already established in the Free Zone and Mainland, we recommend arranging this service as soon as possible to ensure a strong financial management foundation from the outset of your company’s operations. It is advised to promptly arrange this service after establishing your company to guarantee a solid financial management base from the beginning.

Solutions Consulting provides professional audit services, including but not limited to financial audits, operational audits, compliance audits, and more. Our team is composed of experienced professionals with deep industry knowledge and technical expertise, capable of delivering high-quality audit services to you.

Your opinions are important to us. Whether it is a simple question or a valuable suggestion, we are here 24/7. You can call us by phone or email us directly.

2415-18 World Trade Center (South Tower) No.375,Taojin HuangShiDong Road.Yuexiu, Guangzhou, CHINA.

Monday to Friday 09 : 00 - 18 : 00

Solutions believe in the “Real Partner” philosophy

Solutions blends its history and experience with a “next-generation” worldview to build enduring client relationships based on delivering real results. The company aims to create a passionate, high-quality professional team to provide business consulting services for Chinese and foreign people